|

Jeffrey A. Kirk

Financial Advisor – Galion Office Priding himself on his ability to listen to his clients and to capture the essence of what they feel is important to their businesses and families, Jeff is able to help clients create strategies to work towards their life goals. With a strong business acumen honed through over 40 years in the insurance and financial services industry, Jeff’s ability to help people plan and prioritize has a direct impact on their success. Jeff specializes in retirement income planning. He works with a host of corporations where he serves as their 401(k) plan advisor. He also assists their employees by educating them on ways that they can best plan for a quality lifestyle beyond their working years, including helping them to execute sound wealth distribution strategies in retirement. Jeff received his Ohio Life & Health Insurance License in 2001. He is a Securities Series 6 Registered Representative. |

|

Steve Devlin

Financial Advisor – Powell Office Steve joined the agency in 2009. He grew up in Columbus, graduated from Bishop Watterson High School and went on to receive a Bachelors of Marketing in Business Administration from The Ohio State University in 2001. After graduation in 2001, Steve worked as a loan originator for 3 years in Columbus before opening up his own company and successfully running it until 2008 when he joined the insurance industry. Steve holds a Life & Health Insurance license in Ohio and secured his Series 7 securities license in 2007. Steve is involved in the Columbus community through his 25 years and counting of Basketball coaching experience at Watterson H.S. He is also heavily involved in coaching his children’s sports teams. Steve and his wife Alicia have three children: Alayna, Brooks and Blake. |

|

Mike Dostal

Financial Advisor – Bucyrus Office After serving his Property & Casualty clients for over 10 years, Mike decided it was time to better serve those clients and future clients in the financial services arena. Mike holds his Life Insurance license in Ohio and received his Series 6 FINRA registration in 2015. Mike and his team design custom investment strategies for individuals, families and businesses. He strongly believes in the importance of a solid relationship with his clients, with honesty and integrity as the foundation of those relationships. Mike has spent the better part of 30 years of his life in Central Ohio and is currently involved with many local civic organizations. He is devoted to giving back to the local community, as well as helping clients exceed their financial goals. |

|

Megan Rowlinson

Account Manager Megan began her career at Dostal & Kirk in 2010. She holds a Life, Health & Disability Insurance license in the State of Ohio. Megan is the primary service contact for all of the agency’s financial services clients. Megan received her series 6 securities registration in 2023. She is bright and personable, and is intently focused on providing the agency’s financial clients with a memorable customer experience. Megan prepares all client illustrations, processes all applications and manages the client relationship from the beginning of the engagement. Megan works with the firm’s many retirement plan clients, especially individual plan participants. She is their “go-to" person and provides the agency’s first response to client interactions. Whether they require assistance logging on the plan website, assisting with paperwork completion, Megan serves as their first line of administrative support. |

|

Logan Kirk

Financial Advisor – Powell Office Logan joined the agency in 2016 and began his career specializing in Property & Casualty Insurance. In an advisor role, Logan quickly realized the best way to serve clients was holistically, and desired to do so from both insurance and financial services perspectives. Logan holds his Life, Health & Disability Insurance license in the State of Ohio and received his Series 6 and Series 63 FINRA registration in 2022. Logan enjoys helping individuals, families and businesses create financial solutions that are tailored to their needs and circumstances. |

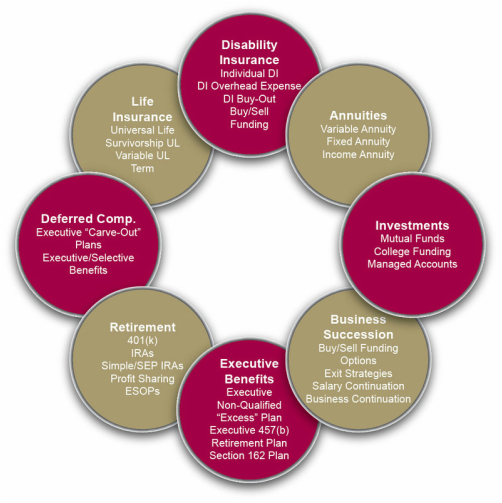

BUSINESS FINANCIAL SOLUTIONS

Our agency specializes in Financial Solutions for businesses. We help privately held companies with a variety of issues, including:

PERSONAL FINANCIAL SOLUTIONS

We work with qualified individuals and families to create and implement customized plans, which address a variety of areas, including:

BENEFITS

Executive Benefits

Executive “carve out” benefits often create a way for privately held companies to reward their best employees (including business owners).

We work with business owners to create:

Group Benefits

As companies compete for talent in a tough employment market, they often find that they can attract and retain the best people with solid benefit plans.

We work with clients to create and service plans in the following areas:

RETIREMENT SOLUTIONS

We specialize in retirement plans. We assist businesses with plan design, fiduciary responsibilities, employee education, and plan communication. We focus on improving investment options and returns, as well as reducing plan administration expenses & fees.

We help to create and service the following plans:

Our agency specializes in Financial Solutions for businesses. We help privately held companies with a variety of issues, including:

- Business Succession Planning

- Life & Disability Buyout Funding

- Key Employee Protection & Retention

- Executive Long Term Care plans

- Taxed-Advantaged Disability plans

PERSONAL FINANCIAL SOLUTIONS

We work with qualified individuals and families to create and implement customized plans, which address a variety of areas, including:

- Retirement Solutions

- Education Funding

- Life Insurance, Disability Income Insurance, & Long Term Healthcare

- Estate Planning

BENEFITS

Executive Benefits

Executive “carve out” benefits often create a way for privately held companies to reward their best employees (including business owners).

We work with business owners to create:

- Deferred Compensation Plans

- Executive Bonus Plans

- Tax-Advantaged Disability Plans

- Supplemental Executive Retirement Plans

Group Benefits

As companies compete for talent in a tough employment market, they often find that they can attract and retain the best people with solid benefit plans.

We work with clients to create and service plans in the following areas:

- Group Life Insurance

- Group Health Insurance

- Group Disability Insurance

- Group Long Term Care

RETIREMENT SOLUTIONS

We specialize in retirement plans. We assist businesses with plan design, fiduciary responsibilities, employee education, and plan communication. We focus on improving investment options and returns, as well as reducing plan administration expenses & fees.

We help to create and service the following plans:

- 401(k) & 403(b) Plans

- Solo (k) Plans

- Profit Sharing Plans

- Simple IRA Plans

- Non-Qualified Plans

- Defined Benefit Plans